Gamify Your Savings: Master Financial Strategy with Game Theory

If you've ever played a video game or attempted to solve a puzzle, you'll know the thrill of tackling challenges and strategizing to win. What if you could apply that same zest for competition to your personal finances? Welcome to the world of gamification, where you can use game theory to level up your savings and investment strategies. Embracing these concepts not only makes managing money enjoyable but also encourages smarter financial habits that can lead to substantial wealth creation over time.

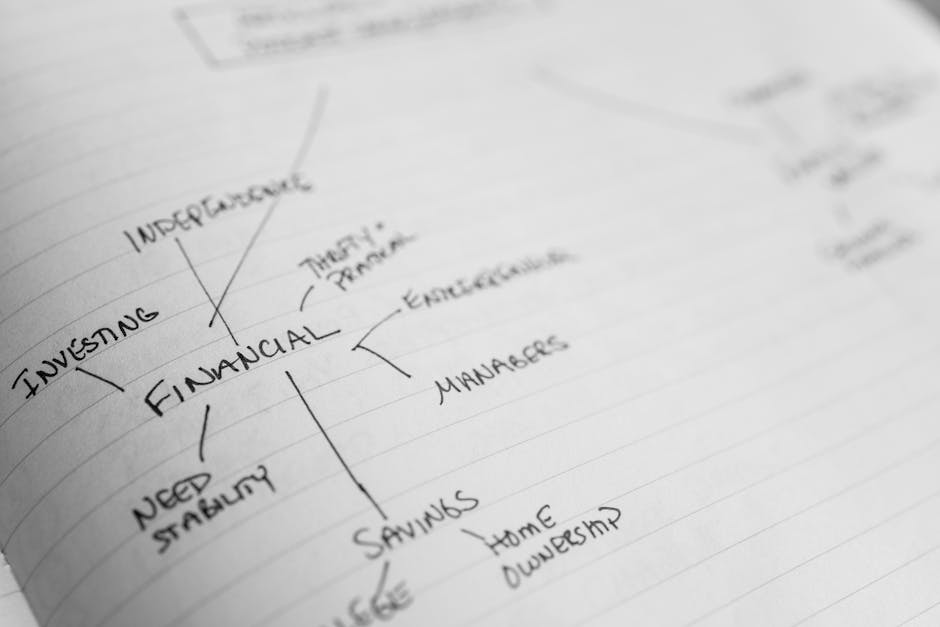

Understanding Gamification and Game Theory

Gamification refers to the use of game design elements in non-game contexts to motivate and engage individuals in enhancing their behaviors. Game theory, meanwhile, is a mathematical framework for analyzing strategic interactions between individuals or entities where the outcome for each participant hinges on the choices of others. Combining these two concepts can help you create an engaging savings scheme and assist you in making well-informed investment decisions.

Imagine your savings account as a leaderboard in a game. The more money you save, the higher your score. Instead of viewing savings as a chore, you can transform saving money into an exhilarating race. Tapping into the psychological advantages of competition and achievement, you can inspire yourself and potentially your family to achieve your financial goals.

Setting Up Your Gamified Savings Strategy

Define Your Goals

Just like in a game where you need to complete levels to win, the first step is defining your financial objectives. Do you want to save for a vacation, a new car, or perhaps set aside an emergency fund? Clear goals provide a sense of direction and allow you to track progress, akin to level achievements in a game.

Choose Your Rewards

Set a reward system for accomplishing your savings goals. This can be both tangible, like allowing yourself to buy that new gadget after reaching a savings milestone, or intangible, such as treating yourself to a day off for reaching a certain financial target. The joy of earning rewards fuels your motivation to save.

Track Your Progress

Now, a game isn't fun without a way to see how you're doing. Use tools like Excel sheets, budgeting apps, or even specialty gamification apps that turn savings into a challenge. Tracking your savings isn't just about numbers—it's about celebrating small wins along the way. If you’re tech-savvy, consider platforms that allow you to visualize your progress dramatically.

For deeper insights into achieving investment success through innovative strategies, check out our post on how your values shape investment choices.

Embracing Competition

Compete with Yourself

Self-competition is a powerful motivator. Take a look at your past months of saving and set higher targets. Gamify this by creating visual progress charts—engaging with analytics can help simulate realistic scenarios with potential rewards. This method not only keeps you accountable but encourages a healthy self-competition.

Involve Others

Why not bring friends or family into your gamified savings challenge? You can create a mini-league where participants earn points for increasing their savings or investing in assets. Social competition can inspire each other to strive for excellence. Perhaps establish a periodic ‘financial game night’ where everyone can share their successes, tactics, and future goals.

Next-Level Investments with Game Theory

While gamification can instill effective savings habits, employing game theory can transform your investment approach profoundly. Understanding the choices of others in the investment landscape allows you to make strategic decisions that could lead to winning outcomes.

Know the Market Players

Investing is a game played between various players, each looking for their profit. By analyzing market trends and the behavioral patterns of other investors, you can derive strategies beneficial for your investments. Recognizing when to buy or sell stock requires understanding not just the numbers, but the motivations and actions of other market participants.

Leverage Predictive Analytics

By using predictive analytics—engaging with data analysis and modeling—you can elevate your financial strategies. Many platforms utilize AI tools to enhance user decision-making. These tools can provide insights into when to invest or withdraw based on current market behaviors. The chess-like strategy can allow you to forecast and adapt your investment strategy to gain a competitive edge.

For more insights on leveraging technology for smarter investments, explore how AI and big data can enhance your investment strategies.

Exploring Unique Investment Opportunities

Invest in Intangible Assets

Intangible assets like intellectual property or brand recognition can yield significant returns. Gamifying this aspect involves identifying rare investment opportunities in emerging sectors—then developing strategies for capitalizing on these spaces. This could mean investing in cutting-edge technologies or unique startups, allowing you to stay ahead while embodying the spirit of a gamer.

Diversifying Through Sustainable Investments

As a strategic player, consider diversifying into sustainable investing. Not only does it align with growing global values regarding ecological consciousness, but investing in green technologies or renewable energy markets can present lucrative opportunities. In a way, you’re playing the long game by making investments that support societal change and financial growth.

For more sustainability strategies, check out how sustainable investing can grow your wealth while financing change.

The Role of Emotional Intelligence in Gamification

Use Your Emotions Wisely

In the realm of finance, emotional intelligence plays a crucial role in our decision-making processes. By learning to manage emotions related to fear, greed, or anxiety, you can strengthen your financial strategies significantly. Gamification helps create an engaging environment around money matters, reducing the stress often involved in savings and investment.

Evolve into an Empowered Investor

Understanding your emotional triggers in spending and investing is key to cultivating wise financial habits. Gamifying your experience by tracking emotional responses to financial situations provides valuable insights into improving your strategies over time.

Embracing Continuous Learning

Financial Literacy through Gamification

Gamified financial literacy programs and unorthodox learning models can deepen your understanding of personal finance. Engaging with interactive platforms or simulators that introduce core financial concepts through gaming can enhance your knowledge base significantly. After all, making informed decisions translates to a winning strategy.

To delve deeper into the world of finance literacy, don’t forget to read how play can revolutionize your financial literacy strategy.

Next Steps: Putting Theory into Action

Gamifying your savings and investments takes strategy, creativity, and consistent effort. When you shift your financial mindset, it becomes less about avoiding losses and more about achieving goals, accumulating wealth, and enjoying the journey. Engage with friends, track your progress, and experiment with innovative methods to improve your financial strategies.

Gamification in finance is not simply a novel idea; it’s your opportunity to become the master of your financial destiny. Get started today and see how the thrill of the game can ignite your financial journey, allowing you to enjoy the challenge while making tangible progress toward your ambitions.

Final Thoughts

The notion of gamification in personal finance offers a transformative view: it is not merely about securing wealth but elevating the very experience of managing it. Whether you're competing against yourself, tracking measurable successes, or analyzing investment moves like a seasoned player, remember that financial fitness can—and should—be enjoyable. By leveraging game theory strategies and leveling up your approach, you can not only transform your financial future but also foster habits that will benefit you for years to come.