Temporal Wealth: Master Time-Weighted Investments for Independence

In today’s fast-paced world, financial freedom often feels like an impossible dream. Yet, with the innovative approach of time-weighted investments, your financial goals may be within reach sooner than you think. Harnessing time can change everything in your investment strategy, enabling you to create wealth while maintaining balance in your life. This comprehensive guide will delve into the transformative power of time-weighted investments, explore actionable strategies, and feature inspiring case studies of individuals who have successfully utilized these concepts toward financial independence.

Understanding Time-Weighted Investments

Time-weighted investments revolve around the concept that the timing of your cash flows—expenditures, deposits, and withdrawals—plays a critical role in wealth accumulation. Unlike traditional investment strategies that often focus solely on the amount invested or returns, time-weighted investing accounts for the duration and timing of each cash flow. This approach not only maximizes your potential returns but also enhances your ability to manage risk.

Investing isn’t just about choosing the right assets; it's about understanding when to enter and exit markets. A key principle in time-weighted investing is that wealth grows exponentially over time, especially when reinvested. This principle emphasizes the importance of using your time effectively. By strategically mapping out your investment timelines, you can align your financial objectives with your lifestyle goals.

The Psychological Aspect of Time Management in Investing

Time, much like money, requires careful management. Successful investors need to understand the correlation between time and emotional resilience. For many, the fear of missing out (FOMO) can lead to impulsive financial decisions, detrimentally affecting long-term goals. Instead, adopting a time-weighted perspective helps you stay calm during market fluctuations, allowing you to focus on the bigger picture. Understanding your psychological triggers can significantly impact your investment strategies and your peace of mind.

Planning begins with a timeline—create one for yourself, outlining significant financial milestones. This approach will help clarify your investment goals. Whether it's saving for retirement, buying a home, or funding your child’s education, designing an investment timeline that matches these goals can encourage disciplined investing.

Practical Steps for Time-Weighted Investing

-

Define Your Financial Goals: Start with clarifying your objectives. Whether you're saving for a short- or long-term goal, understanding the nature of these goals will influence your investment timeline.

-

Determine Your Investment Horizon: Think about how long you're willing to hold an investment. Are you looking for immediate returns or willing to wait for long-term growth? Your investment horizon will dictate the types of assets you consider.

-

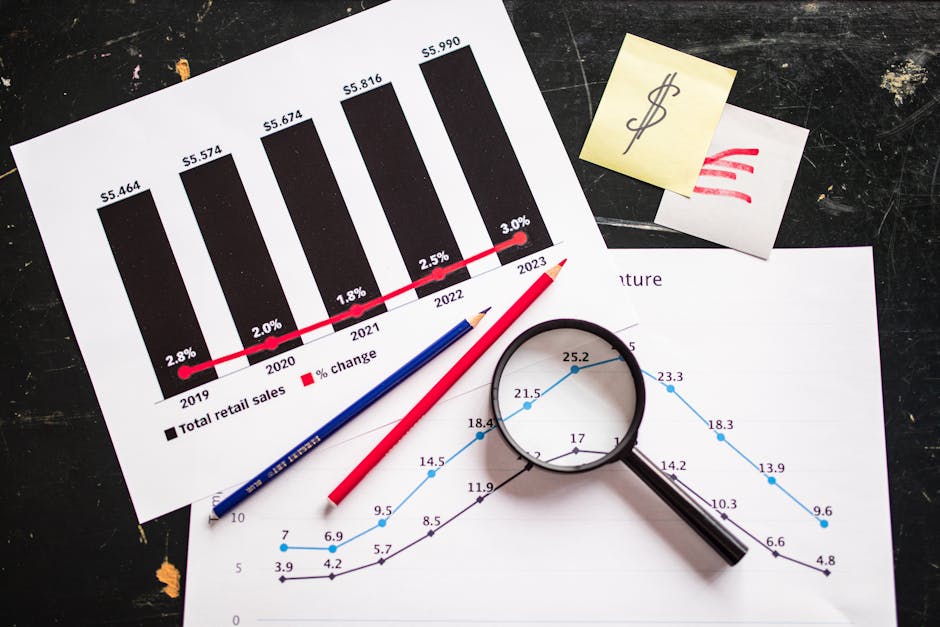

Create Cash Flow Projections: Map out expected expenses, income from investments, and other cash flows over time. A clear visualization of when and how money will come in and out will help you track your progress and adjust your strategy accordingly.

-

Diversify Strategically: Maintain a diversified investment portfolio while taking advantage of the timing. Consider using local development projects or micro-investing initiatives that align with your interests and goals.

-

Regular Review and Adjustment: Periodically revisit and revise your timeline to accommodate changes in your financial situation, lifestyle, and investment market. Flexibility will enhance your capability for substantial growth.

Case Studies: Real-Life Impact of Time-Weighted Investments

Case Study 1: Sarah and the Power of Compound Returns

After securing a stable job, Sarah chose to allocate a portion of her salary into an index fund, following the time-weighted investment model. By consistently investing monthly and letting her dividends reinvest, she achieved substantial growth over a decade. The compounding effect, compounded by wise timing during market dips, allowed her to build a six-figure portfolio without sacrificing her lifestyle.

Case Study 2: James and Lifestyle Balance

James was meticulous about balancing his career and personal life. His strategy incorporated time-weighted investments by leveraging his passion for agriculture. By investing in ecological assets, he not only nurtured his personal values but also built a robust portfolio that supported his early retirement plan.

These case studies exemplify that with the right perspective and commitment, anyone can achieve financial independence through time-weighted investments.

Mapping Your Investment Timeline

Here’s how you can create your investment timeline:

-

Identify Major Life Events: Start by listing key life milestones, such as marriage, home purchase, and retirement. This will anchor your investment timeline.

-

Align Financial Goals with Life Events: Use your timeline to assign financial milestones to these events. For example, if you plan to buy a home in five years, set a specific savings goal and investment strategy leading up to that time.

-

Set Placeholder Cash Flow Projections: For each event, estimate the required cash flow, taking into account contributions from your investments. Adjust these estimates regularly as your circumstances evolve.

-

Anticipate Market Conditions: Utilize external resources such as Harvard Business Review or Moz to stay informed of market trends and adjust your investments to capitalize on potential opportunities.

Balancing Time with Investments

Balancing your investments with personal life goals involves continuous self-assessment and adjustments. It’s crucial to ensure that your investment strategies don’t overpower your lifestyle ambitions. Create volunteer opportunities or hobbies that generate an additional income stream while enriching your personal life. This approach takes on an innovative facet of investing by incorporating digital identities and unique opportunities.

By integrating your passions—like artistic pursuits or athletic interests—into your investment strategy, you yield a holistic approach to financial freedom that encompasses both financial and personal growth.

Next Steps Towards Financial Independence

The journey toward achieving financial independence is dynamic, requiring thoughtful consideration of your time-weighted investment strategies. Implementing these practical steps enables you to take control of your finances while maintaining balance in your personal life. Here are quick actionable steps to start your journey today:

-

Educate Yourself: Read books or take online courses focusing on investment strategies and financial planning.

-

Engage with Professionals: Seek guidance from financial advisors who understand the nuances of time-weighted investments.

-

Leverage Resources: Make use of online tools for investment tracking, budgeting, and goal organizing.

-

Stay Persistent: Success doesn't happen overnight. Stay committed to your timeline and be adaptable to changes.

Embrace the power of temporal wealth. By harnessing time and thoughtful investment strategies, you can pave your own path toward financial independence and achieve a life that resonates with your values and aspirations.

Final Thoughts

Financial independence isn’t merely a long-term dream—it is a strategic endeavor that starts with mastering the time-weighted investments model. The implications of your investment decisions proliferate over the long run, amplifying both wealth and personal fulfillment. By understanding your timeline, aligning your investments with your life goals, and actively managing your psychological triggers, you can forge a sustainable financial future.

Take action now to secure your prosperity and peace of mind. Start planning, stay disciplined, and watch as your investments flourish over time.