The Subconscious Spending Game: Harness Your Mind for Wealth

Understanding how our minds influence financial decisions can unlock pathways to greater wealth. The subconscious spending game reveals how our mindset shapes not just our behaviors but also our financial outcomes. With thoughtful strategies, you can harness your inner instincts to build a solid foundation for wealth. Join us on a journey to better understanding your financial psyche and how you can redefine your spending habits for long-term success.

Your Money Mindset: A Game Changer

We often overlook the profound impact our thoughts and beliefs have on our financial well-being. Research suggests that our mindset shapes our perception of money, affecting our spending and saving behaviors. Take a moment to reflect: how do you feel about money? Is it a friend or a foe? The answer to this question can dictate your financial trajectory.

Experts reveal that those who view money as a tool for empowerment tend to exhibit healthier financial habits. For example, cognitive behavioral therapy (CBT) principles can help reframe negative financial beliefs into positive affirmations. This shift in mindset not only cultivates a better relationship with money but also encourages smarter investing choices.

Moreover, wealth-building is not solely about making more money; it is equally about how effectively we spend and save what we have. A practical approach might be to use psychological strategies that influence motivational behaviors, allowing for improved financial decision-making.

The Role of Emotional Triggers in Spending

Recognizing emotional triggers that lead to impulsive spending can transform your financial habits. Factors like stress, boredom, or social comparison can prompt unnecessary purchases. Think of the last time you treated yourself after a long day—did you really need that item, or was it a moment of emotional escape?

Mindfulness practices can enhance self-awareness about these triggers. By identifying emotional spending patterns, you can implement strategies to diversify your coping mechanisms. For instance, instead of turning to shopping for comfort, consider engaging in activities like journaling or exercise to elevate your mood without impacting your budget.

To build on this emotional resilience, consider adopting practices outlined in the article on mindful spending, where emotional intelligence plays a crucial role in making better financial decisions. Engaging with your emotions not only aids in financial growth but also strengthens overall well-being.

The Power of Habits: Rewiring for Success

Habits are the cornerstone of financial success. Studies show that 40% of our daily actions are habitual. By intentionally designing financial habits, we can achieve remarkable results. Start small by setting aside a fixed amount for savings each month, or try linking purchases with a clear purpose—this aligns spending with your financial goals.

Gamifying these habits can make the process more engaging. Consider making a game out of saving where you reward yourself for reaching certain milestones. This approach can transform mundane saving routines into exciting challenges, keeping you motivated along the way.

Effective budgeting often begins with self-awareness and commitment to establishing healthy spending habits. The article on budgeting strategies provides detailed insights on how to tailor these habits to fit your lifestyle and aspirations.

The Subconscious Spending Game: Leveling Up Your Financial Game

Mindset plays a captivating role when playing the subconscious spending game. How can you leverage this understanding? Start by playing around with different spending practices that reflect your values and financial goals. Stay away from spontaneous decisions that disrupt your progress and focus on building experiences that align with who you are.

To level up, consider the knowledge shared in the blog post on financial storytelling. This narrative approach allows you to articulate your financial goals, making them more tangible and relevant. Sharing your financial journey not only motivates you but also inspires others to do the same.

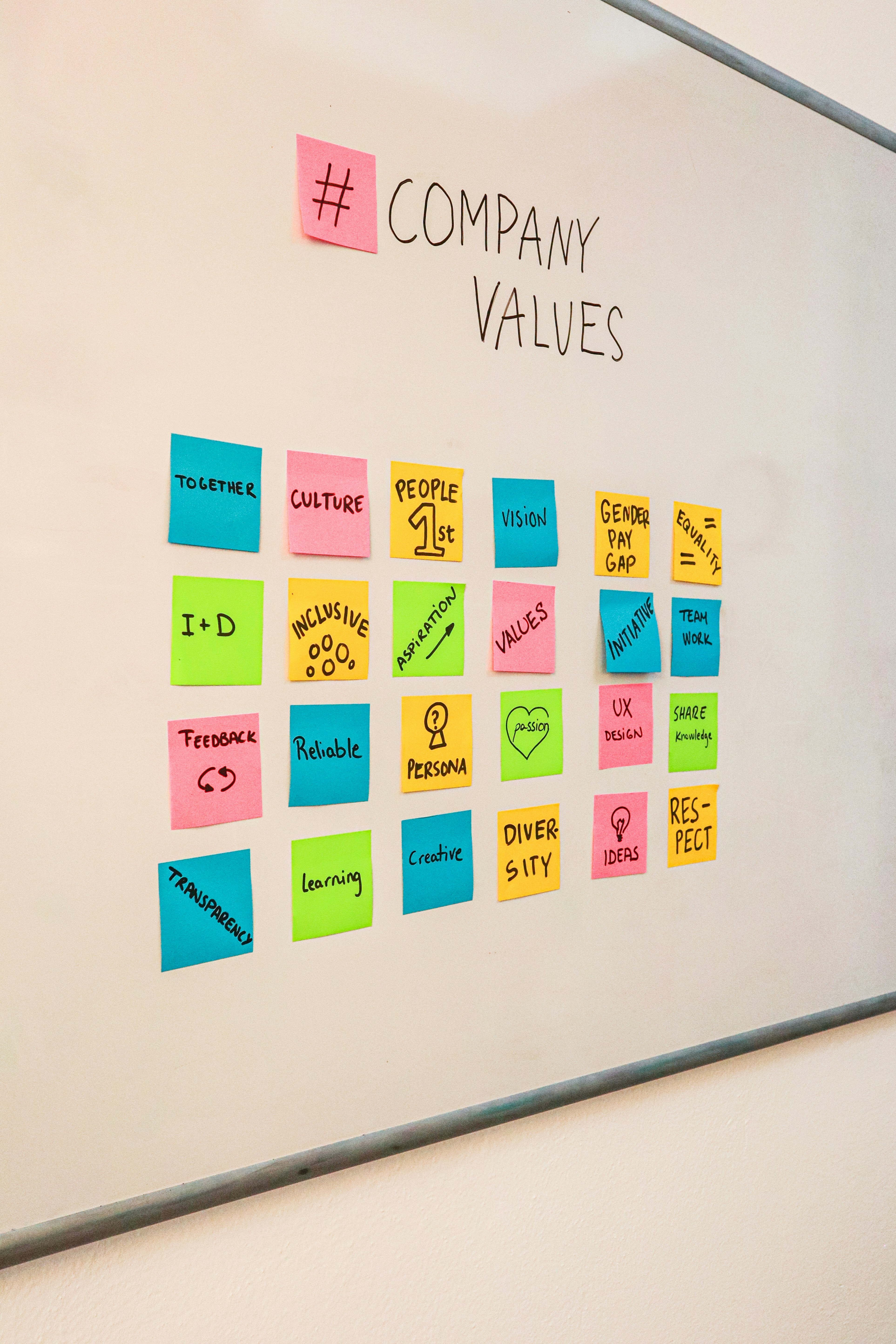

Aligning with Core Values

Your spending decisions should reflect your values. Before making a purchase, ask yourself: "Does this align with my financial goals?" Engaging in this question can lead to more thoughtful purchases and reinforce a future-oriented mindset.

Behavioral finance experts emphasize the importance of aligning financial decisions with personal values. It creates a sense of fulfillment beyond mere consumption. Choosing to invest in experiences or knowledge rather than material possessions can significantly enhance your wealth—not just financially, but emotionally.

Mindfully consider enhancing your financial literacy, reflecting on valuable learnings from societal values on investment choices. Gaining knowledge is a key aspect of responsible decision-making and wealth-building.

Understanding the External Forces

Your financial behavior does not occur in a vacuum—it’s influenced by societal expectations, cultural norms, and external conditions. Different economic climates promote varying financial habits; for instance, inflation can trigger a scarcity mindset, leading to unjustified hoarding behaviors.

Understanding how macroeconomic factors interact with individual financial behaviors can be enlightening. When certain trends, such as the increase in digital currencies or social media influencers pushing spending on luxury items, take hold, it becomes essential to differentiate between societal pressures and personal desires.

Keeping informed through thought leadership avenues like Harvard Business Review strengthens your awareness of external influences, empowering you to make choices more aligned with your long-term goals.

Building Wealth Through Deliberate Investment Choices

Saving is vital, but investing is where wealth truly multiplies. A strategic investment plan involves understanding your risk tolerance, market trends, and ultimately deciding which assets align with your financial objectives.

Micro-investing, for example, allows individuals to dip their toes into the investment waters without needing a hefty starting capital. Platforms enabling this functionality have grown immensely, providing avenues for individuals to manage spare change and turn it into wealth—efforts discussed in micro-investing strategies.

At the same time, consider your approach to ethical investing. Supporting causes that reflect your morals not only cultivates a sense of satisfaction and purpose but also promotes healthier investment trends. Delve into articles focusing on the benefits of sustainable investing to broaden your horizons.

The Wealth of Experiences over Materialism

Research reveals that people derive greater satisfaction from experiences than from material possessions. Creating memories fosters a rich emotional foundation that contributes significantly to overall life satisfaction.

Experiment with transferring financial priorities from shopping sprees to experiential investments. Think of group travel, culinary classes, or time spent volunteering—these experiences nurture your personal growth while creating lasting memories.

Additionally, the concept of reallocating funds towards experiences is encapsulated brilliantly in adventure-driven financial planning. This article emphasizes aligning your financial goals with enriching life experiences, offering a rewarding alternative to traditional spending strategies.

Final Thoughts: Play the Game Wisely

Navigating the subconscious spending game requires reflection, strategy, and a willingness to change. Start with understanding your mindset, recognizing emotional triggers, and implementing intentional habits. Your financial journey is a unique story—craft it with purpose.

As you work towards amplifying your financial literacy and independence, embrace the notion that wealth-building is a lifelong game. Equip yourself with the knowledge and mindset to welcome new strategies into your financial playbook.

To build wealth, invest in yourself, your experiences, and your relationship with money. This rhythm can symbiotically transform your financial habits. Discover your inner financial strengths; mastering your subconscious could be your most valuable asset yet.

As you step off this guided path, remember: your mind is a powerful tool in wealth creation. Play wisely, stay informed, and cultivate resilience, so you can ultimately transform your financial future.